What does it mean to refinance your mortgage?

It took some time, but mortgage rates are now responding to last week’s plunge in bond yields stemming from fears about systemic financial risk in the U.S. and Europe.

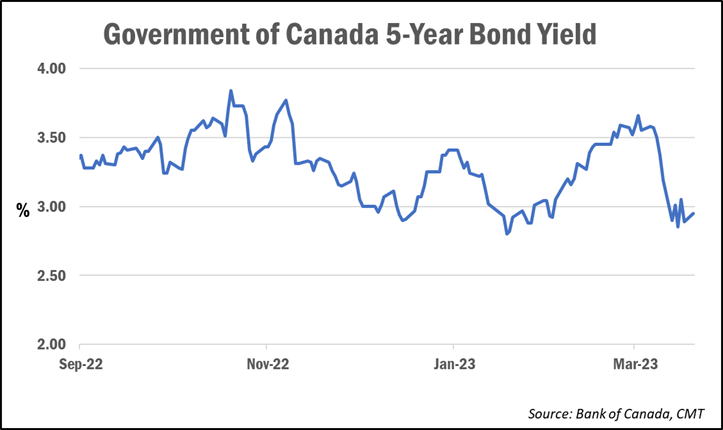

As of Monday, numerous mortgage lenders and brokerages had started cutting fixed mortgage rates, some by as much as 60 basis points, or 0.60%. That follows a roughly 70-bps plummet in 2- and 5-year Government of Canada bond yields (which typically lead fixed mortgage rates) in just a two-week period.

Average nationally-available deep-discount 5-year fixed mortgage rates are now about 30 basis points lower than where they were at the end of last week, according to data from MortgageLogic.news.

The extreme volatility in financial markets began with the collapse of two regional U.S. banks—Silicon Valley Bank (SVB) and Signature Bank—earlier this month.

Over the weekend, the world’s largest central banks came together and sought to reassure rattled markets in an effort to keep the banking crisis from spreading. The Bank of Canada joined other central banks, including the U.S. Fed, Bank of England, European Central Bank, and more, in announcing measures to ensure sufficient market liquidity.

The central banks said they would increase the frequency of their U.S. dollar auctions from weekly to daily in order to reduce potential strains on global markets.

“Growing concerns about the global financial system’s ability to withstand a series of shocks, and the tendency of financial markets in such circumstances to assume the worst until convinced otherwise, have caused a surge in demand for safe-haven assets, such as government bonds. Investors are now more concerned about the return of their capital than they are about the return on their capital,” Integrated Mortgage Planners broker Dave Larock wrote in his latest blog post.

He commented that, until today, fixed mortgage rates had been slow to follow the steep decline in bond yields, and touched on several of the reasons why.

“Lenders, and the institutional investors who fund their mortgages, won’t be in a hurry to put more of their capital at risk until they are confident that the recent bank failures aren’t precursors to a broader market meltdown,” he noted.

“Also, while a lender’s base borrowing rates are falling, when they plunge in response to financial stability concerns there is always an accompanying increase in the risk premiums that lenders must pay.”

Downward pressure on mortgage rates

The current stress in the financial system will likely lead to a tightening of credit availability, analyst Ben Rabidoux of Edge Realty Analytics noted in his latest Housing and Mortgage Market Trends report for Mortgage Professionals Canada.

“That’s potentially bad news, but at least in the short term it means downward pressure on mortgage rates,” he said.

For prospective buyers and homeowners with mortgage renewals coming up, the big question is how long the market volatility persists and whether fixed mortgage rates might potentially go lower.

But seasoned rate-watchers like Ron Butler of Butler Mortgage are reluctant to offer forecasts in the midst of such uncertainty.

“This is the most volatility in financial markets I have seen since 2008,” Butler told CMT. “I don’t have a clue what will happen, I can only go day by day.”

An opportunity for mortgage borrowers?

So, what’s the current play for mortgage holders? Butler said the current conditions could offer some variable-rate borrowers who have seen their rates soar, the opportunity to lock into a fixed rate.

“But be careful and avoid 5–year fixed rates, which many lenders insist on when converting to fixed,” he added. “Be cautious, learn precisely what your variable penalty is [to break your mortgage early] and then seek out 2- or 3-year fixed-rate offers from other lenders, calculate the penalty cost and see if there is a mathematical advantage.”

For those in the market for a new mortgage, Butler continues to advise borrowers to avoid new variable-rate mortgages, even though the recent market instability has moved ahead forecasts for potential Bank of Canada rate cuts to this year.

“There is still a premium cost compared to short-term fixed-rate mortgages and it makes zero sense to pay more to take on the risk of a rate increase, even if it is small, when a 2-year fixed product is lower,” he added. “Forecasts have been too wrong for too long, don’t consider a variable until this extreme economic volatility is way in the rear-view mirror.”

As for where mortgage rates go from here, that remains unknown and subject to what happens in the near-term with this banking crisis, said Larock.

“Additional mortgage rate drops may be forthcoming if the financial markets stabilize, and bond yields remain at their current levels but that will depend on how things play out over the near term,” he noted. However, “the range of possible outcomes is still wide.”