The sharp drop in February’s headline inflation reading suggests rates have now peaked and that the next rate move will be a cut.

That’s the take from ING’s Chief International Economist James Knightley following a second straight month of Canada’s annual inflation rate surprising to the downside.

The consumer price index slowed to an annual rate of 5.2% in February, Statistics Canada reported on Monday, marking the largest deceleration since February 2020. That’s down from a reading of 5.9% in January and slower than the 5.4% rate expected by a Bloomberg survey of economists.

Most economists believe the drop in inflation all but guarantees another rate pause by the Bank of Canada at its April 12 meeting.

Some, like Knightley, are going further and calling for at least one 25-basis-point rate cut before the end of the year, particularly against the backdrop of the current global banking challenges. That would knock the Bank’s overnight target rate back down to 4.25% from its current rate of 4.50%.

“We still think the next move in the BoC policy rate will be downwards and that the first cut is likely to come before the end of the year,” Knightly wrote. “Canada’s greater exposure to interest rates rate hikes via a high prevalence of variable rate borrowing means consumer activity should slow through 2023.”

Additionally, higher household debt levels in Canada—more than 180% of disposable income versus 103% in the U.S.—means Canada is “especially exposed to the risk of a housing market correction in a rising interest rate environment.”

“Falling inflation rates will give the BoC the room to respond with looser monetary policy, especially with the Finance Minister Chrystia Freeland suggesting her upcoming budget will ‘exercise fiscal restraint’ to help in the battle against inflation,” Knightly added.

BMO’s Douglas Porter added that, with inflation subsiding at its current pace, “there’s really no underlying reason for the Bank to hike further.”

“Overall, the Bank’s pause looks prudent, and we expect them to stay at current levels for quite some time, barring a major flare-up in the banking turmoil,” he wrote.

The rise in shelter costs is slowing

Digging into the details of StatCan’s February inflation report, shelter costs rose at a slower pace year-over-year for the third consecutive month.

Slower growth was recorded in homeowners’ replacement cost, which is related to the price of new homes, which rose at an annual pace of +3.3% compared to +4.3% in January. Other owned accommodation expenses, which includes real estate commissions, also eased to +0.2% in February, down from a rate of +1.1% in January.

However, one shelter component remains one of the biggest drivers of overall inflation: mortgage interest cost, which climbed by 23.9%, up from +21.2% in January. This was the largest increase in 40 years, Statistics Canada noted. “Many will thus point to the BoC as the ’cause’ of inflation,” wrote BMO’s Porter, “although note that inflation is still 4.7% even excluding mortgage interest costs.”

That contributed to a moderate 0.3% month-over-month gain in CPI excluding food and energy.

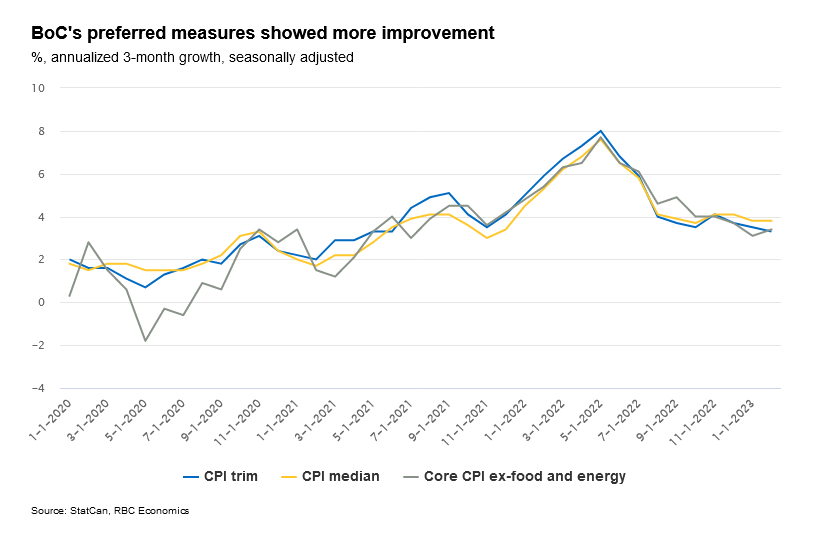

The Bank of Canada’s preferred measures of core inflation also continued to ease, with CPI trim falling to +4.8% (from +5% in January), CPI median down to +4.9% (from +5%) and CPI common decelerating to +6.4% (from +6.6%).